I’m Joseph Giove, founder, and researcher for BlackBookCrypto.com.

I was invited to YieldNodes annual audit that occurred July 18th of this year. What I share here is the result of that audit, my impressions, observations, and conclusions. I hope you find my report informative and useful.

You can view the full video report here on my YouTube channel.

Introduction

YieldNodes held an annual audit to demonstrate their transparency to members. They invited auditors randomly out of their pool of members. None of these were employees or owners of YieldNodes and none of them were paid to attend. YieldNodes did pay travel and lodging expenses and did give them a tour of the beautiful, historic island nation of Malta, where the company is headquartered.

YieldNodes made no attempt to sway the auditors’ opinion and literally laid open the books and answered all auditors’ questions.

They were all members of YieldNodes, each participating at some level in the program, so they were not independent auditors because they have an interest in the viability and stability of the program.

What this blog is sharing here, is an objective report of that experience.

Please note that noting in this report should be considered as financial advice. I am only offering my opinion.

What and Who is YieldNodes?

YieldNodes was founded in 2019 by Urs Schwinger and Steve Hoermann to join the advantages of cryptocurrency trading, staking and MasterNoding. The result is a server rental program in which members’ shared resources provide economies of scale and high monthly yields in a passive income form.

In the interest of transparency, YieldNodes allows annual audits of their books to a limited number of members.

- It’s a MasterNoding Server Rental + Decenomy (A series of coins that have a purpose and specific used cases.)

- An Entrepreneurial team of 50+ across Europe…Malta, Germany, Italy, Austria, Portugal, Belgium.

- They generate revenue via crypto price fluctuations, gains and losses, master noding, and staking.

- They have 2000-4000 master nodes operated with POS staking.

- They have 19 projects, i.e. coins, DEXs, use cases.

- First Decenomy country partner: São Tomé and Principe.

- 1000s of members worldwide sharing resources and participating in Yield Nodes.

- Average monthly yield last 33 months: 10%

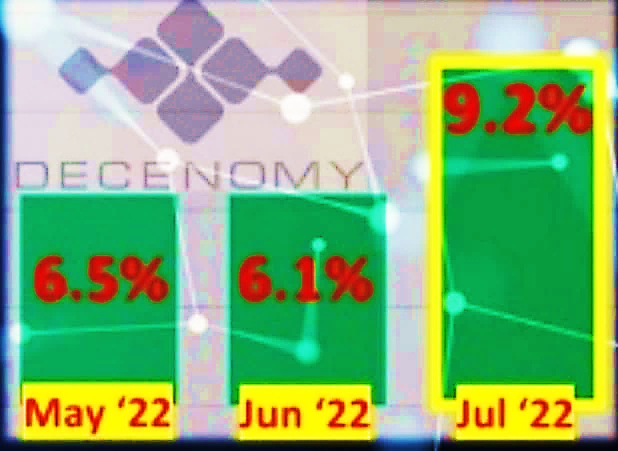

- Yield generated and paid to members for July 2022: 9.2%.

MasterNoding

YieldNodes revenue and yields are NOT based on equity appreciation or interest payments like you might be used to. YieldNodes is a “pay for service” system, in which members participate, that generates income based on an algorithm embedded within each masternoded coin on the blockchain.

That description probably sounded like Greek to most people unfamiliar with networks and blockchain, so let’s check another analogy.

“YieldNodes is a ‘pay for service’ system, in which members participate, that generates income based on an algorithm embedded within each masternoded coin on the blockchain.”

Imagine being hired by a business park to bring qualified customer leads into the park that meet certain criteria.

So, you stand at the entrance and direct the traffic going by. If someone meets the criteria, you validate them, then send them in to the park.

Every business in the park benefits from this and pays you a reward for each customer transaction.

Eventually you become so good, that the happy management of the park decides to include you in making certain decisions and pays you a reward for this help in the park’s governance.

Algorithm

MasterNoding on the blockchain accomplishes all these tasks but is automated through a mathematical formula called an algorithm.

The YieldNodes business model incorporates this algorithm in its own unique formula that deploys its shared resources for the benefit of all its members.

Monthly Yields (Sept 2019- May2022)

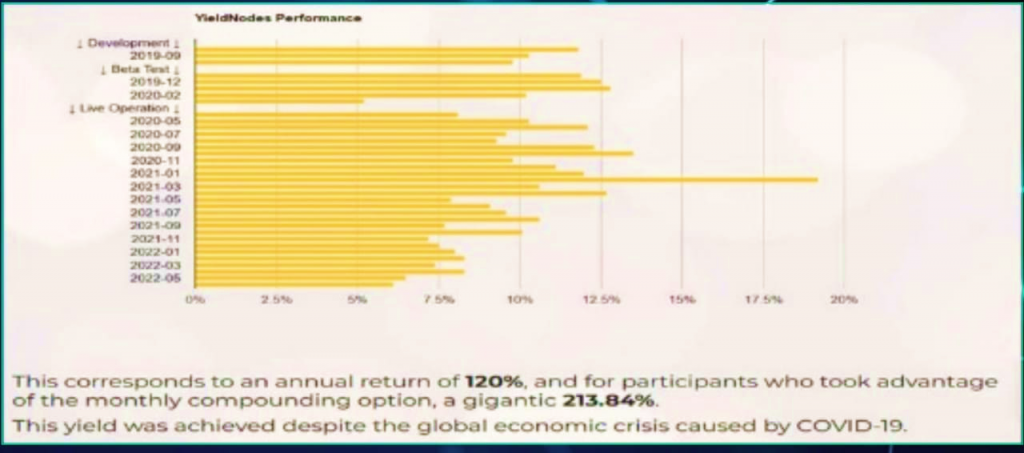

That benefit is in the form of monthly Yields that have ranged from 5% to 14% since the company’s inception in 2019.

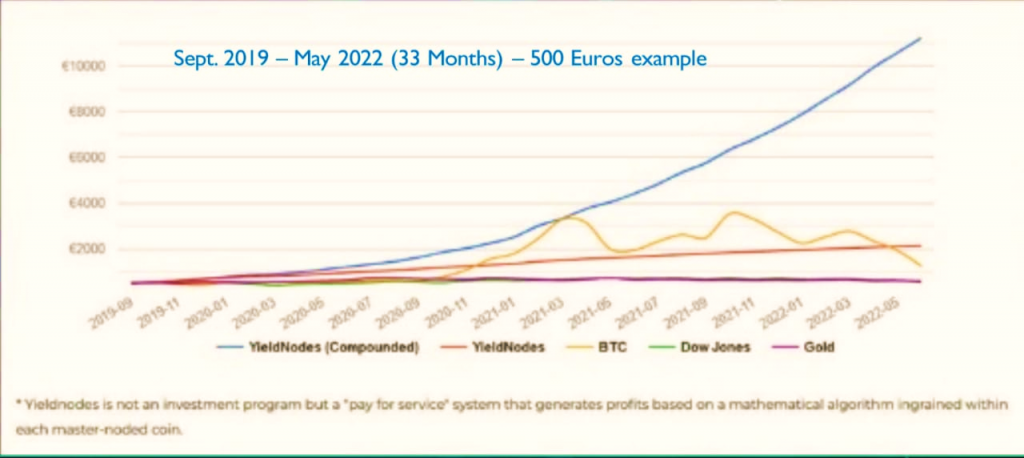

YieldNodes Performance vs BTC, Dow jones, Gold

YieldNodes performance from 2019 to May this year, shows very decent performance over the Dow Jones and Gold. It didn’t see the highs Bitcoin saw over those years, but didn’t see the lows or crashes either.

Looking at the blue curve, which is the Yield Nodes returns being automatically compounded, would have turned a 500-euro initial deposit into over 10,000 euros, in just 3 years, across a period that saw the pandemic and major corrections in many asset classes. (Disclaimer: past performance may not be indicative of future performance.)

It is these kinds of returns that create suspicion that YieldNodes must be either a scam or Ponzi scheme, which is why this article explains what YieldNodes is and how it differs from most other passive income opportunities in crypto or traditional fiat investments for that matter. It’s also why YieldNodes opens its books to members in its annual audits.

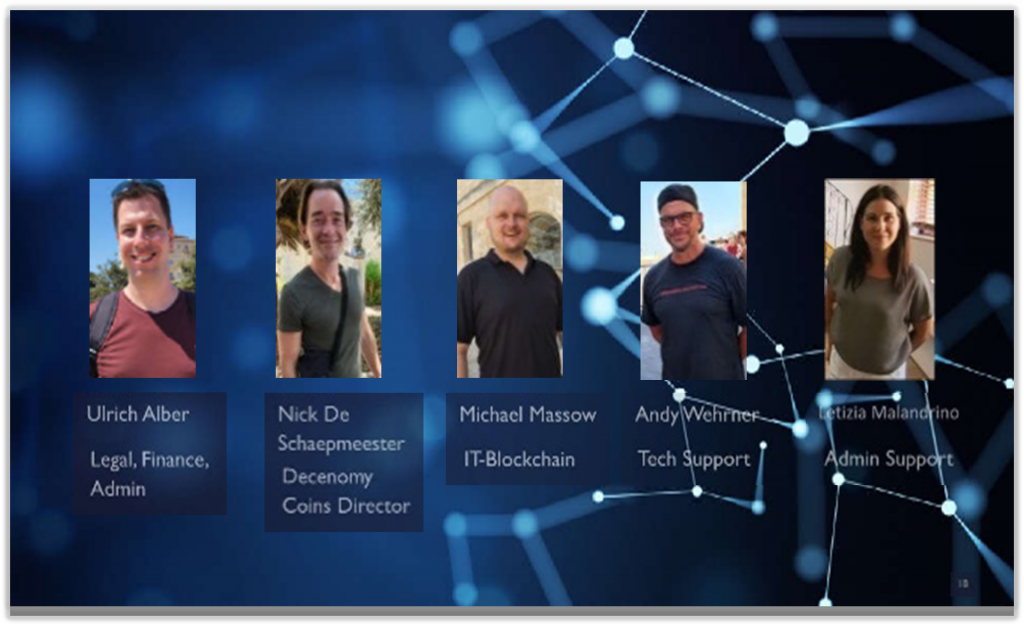

Here’s a look at the company’s core team.

YieldNodes- Decenomy Team

Decenomy is the parent company, which manages all the projects, coins, decentralized exchanges, and any other project acquisitions. YieldNodes is the arm that markets publicly and manages members, deposits, and payouts. The team is real, these are good, high-minded people with integrity and a passion for what they do.

YieldNodes-Decenomy Team

Yield Nodes- Decenomy Facilities Walk-Through

Let’s have a quick walk through of the YieldNodes and Decenomy facilities. The team is distributed throughout Europe, so these offices (shown in this video Report) are used mostly as meeting places when various aspects of the team converge in Malta for face-to-face meetings. Other meetings are done remotely.

So, first is the YieldNodes-Decenomy office, and next is the Decenomy hub, which will be completed in about 6 weeks. The Hub is Urs’ vision for a community meeting place for members and workspaces for the team. They have plans for many hubs, next one planned is in Germany.

Audit Results

- All auditors are bound by a Non-Disclosure Agreement. What I can share publicly is limited by the non-disclosure agreements all auditors signed, and for good reason. YieldNodes’ and Decenomy’s intellectual property is their unique algorithm and system applied to pooling deposits and resources into the substantial yields I just showed you. As a member I want that IP protected for long term viability of the project. But us auditors were shown all the numbers, I just can’t share them with anyone else. I am sure any reasonable person can understand this.

- Steve showed current funds status, all balances, user count, deposits, withdrawals, compounds, total invested vs total deposits, total assets, and total payouts.

- Payout more than collects each month.

- That the company is over collateralized by 30%.

- Liquidity is a mix of Bitcoin and Decenomy coins, no fiat in liquidity pool.

- Steve showed back-office system.

- Processes for verifying revenue, deposits, withdrawable funds, emergency withdrawals, yields and payments.

- Manually approves each payout.

- Substantial buffer for the crypto winter.

- Growing knowledge base.

- Urs showed balance sheet, amount of funds in each wallet, distribution of funds in all coins, staking and MasterNodes.

- Logged into each wallet, verified location, and reconciled wallet balances with balance sheet.

- Wallet-MasterNoding-staking balances confirm 30% over-collateralization.

- Showed that new money is not required to sustain operation and profitability.

Audit Insights

There are insights from 3 other auditors and brief interview with CEO Steve after the audit. They are each about 5 to 7 minutes and provide additional perspectives and answers that will be helpful.

You can view them in my full Audit Report on YouTube by clicking here.

- James Pelton

First James Pelton, his full review you can find on his YouTube channel by his name.

- Adrian Edward Steven

- Bo Schjønning-Larsen

DECENOMY

“Decentralized economy”

Decenomy is Urs Schwinger’svision for a decentralized economy based on the blockchain. Urs Schwinger is a creative genius, to have this broad and far-reaching vision.

Vision

- Decenomy is based on the idea of analyzing the deficits of the current economic system and redefining economic rules with completely new blockchain solutions.

- We will work with several coins and their associated blockchains at the same time. We see that blockchain technology by itself does not solve problems, but it offers the tools for new economic solutions to be built upon them.

- We want to give the real economy and the consume their money back and create a balance between the money supply and real goods and services, and the associated value creation.

- We are pragmatists and come from the real economy and know that we also need idealism to design and define realistic goals for the future.

Genesis

Urs Schwinger gave a presentation Decenomy and the island nation off Africa that is a test case for Decenomy.

Basic principles:

Decenomy (Decentralized Economy) as a counter concept to DeFi (Decentralized Finance):

- Based on real assets (instead of virtual assets).

- Sector and function coins (instead of application coins).

- Rewards (instead of interests).

- MasterNodes-Network with Staking-Consensus.

- Regulatory mechanisms based on smart contracts.

- Security token and NFTs for asset registry.

- Transparent interfaces for transaction taxes.

Hub structure

Decenomy Hubs as gateways between the real economy and the virtual blockchain world.

- Meeting points.

- Decentralized data centers (distributed around the world).

- Clear specifications for the classification as a hub.

- Support and training for the using of Decenomy.

- Show room for Decenomy projects’.

- Funding and tokenization of real Decenomy assets.

São Tomé and Príncipe

- African island with 200,000 population.

- Former Portuguese colony.

- Poorly functioning economy.

- First official country partner from Decenomy.

- Decenomy coins will get official currencies.

- Decenomy leaders are official advisers of the president from São Tomé und Príncipe.

- Coordinated laws.

- Support by the local university.

- Full banking license.

São Tomé and Príncipe-A Natural Paradise

Real Projects

The first real world projects running on the DECENOMY platform Mobolith

- Decentralized mobile charging infrastructure for electric cars

HTC

- EU-awarded solution for ecological purification of sewage sludge with simultaneous recycling of contained raw materials.

Photo-voltaic, hydropower and wind power

- Sustainable energy supply (São Tomé, Malta, a.o.).

My friend

- AI based Avatar to support the the families and friends from dement people.

SlyHit

- C2C Penny auction.

ESBC

- Online platform for betting based on DECENOMY coins.

To Do

White Paper

- together with community.

Workgroup server

- monday.com.

Marketing

- News server.

- Distribute messages decentrally.

- Different languages.

Websites

- Decenomy site.

- Coin sites.

Establishment of project managers

- Marketing, PR, social channels.

- Coins.

- Real projects.

- Support.

- Legal contracts, KYC.

Conclusion

YieldNodes has been operating profitably for 3 years as of this writing. They give members access to their audits and are transparent about risks and monthly yields. The platform is a new way of profiting and earning passive income from the new blockchain economy, without having to become mired in the complexities of technical analysis, masternoding, researching, and tracking fundamentals and trends.

YieldNodes-Decenomy is a viable, real project with an inspiring future, and a team that cares about its members and holds them as its number one priority. The risks are in the security of the wallets, which they recognize and are constantly on top of the hacking attempts and state-of-the-art security. It is not a scam or Ponzi scheme.

On the contrary, the team has a long-term vision, and they fully intend to fulfill it. Most auditors, including myself, will be adding to their YieldNodes balance, which is part of a diverse portfolio. Like CEO Steve always cautions: always diversify and realize that most things in crypto and financial markets have high volatility and are high risk.

I hope you found value in my YieldNodes Audit Report. Please read more here at the YieldNodes site.

I have also written and produced a comprehensive review of YieldNodes here on my blog…

and here on my YouTube Channel.

If you need any help getting started with YieldNodes, please DM me here.

Joseph Giove