This is my ongoing, comprehensive review of YieldNodes from my personal experience investing in their server rental program. Since it’s a unique “pay for service” system, I want to give you the benefit of my research into its mechanics, management, and risks, which I did before I invested.

I will be updating this review regularly, so be sure to check back monthly to see my returns, under “UPDATES” below.

If you decide to participate in YieldNodes and use the links on this page or my site, I can help you get started. Just contact me and I’ll be happy to help. The link gives me a small “thank you” bonus but doesn’t cost you anything. If my objective review helps you make an informed decision, my goal is achieved regardless of how you choose.

My investment is going very well but it’s important to understand the risks. Anything to do with blockchain and crypto carries certain risks and it’s important to understand those before putting your hard-earned money at play. I will be addressing these risks herein.

I hope you find my YieldNodes review useful in your assessment.

Let’s dive in…but first, some update statistics.

UPDATES

- Masternodes operated: 2000-4000, Masternoding alternating with POS Staking

- Integrated projects contributing to the yield: 19

- Revenue generated for November 2021: 10.1%

- Revenue generated for December 2021: 7.2%

- Revenue generated for January 2022: 8.0%

- Revenue Generated for February 2022: 8.3%

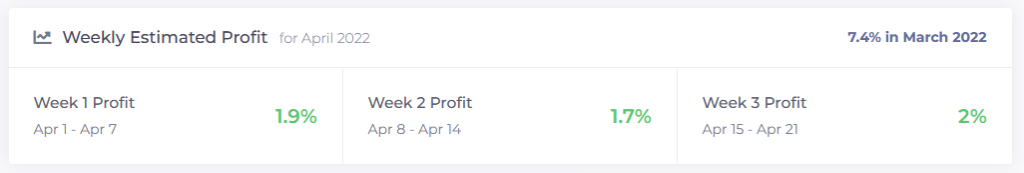

- Revenue Generated for March 2022: 7.4%

- Revenue Generated for April 2022: 8.3%

- Revenue Generated for May 2022: 6.5%

- Revenue Generated for June 2022: 6.1%

- Revenue Generated for July 2022: 9.2%

- Revenue Generated for August 2022: 6.1%

- Revenue Generated for September 2022: 6.1%

Note: Average monthly yield for Nov., 2021 thru August 2022 was 5.3% during Bitcoin’s 70% and the NASDAQ’s 30% corrections. - Average monthly yield (last 34 months): 9.8%

– this equates to an annual yield of 120% (or 213.84% compounded)

As an invited auditor for the YieldNodes annual audit in July 2022, here is my full audit report.

I sat down with YieldNodes CEO Steve Hoermann to discuss his views on the current cryptocurrency landscape and how this affects yields, revenue, and potential investors in the YieldNodes masternoding project.

A May 2022 discussion with YieldNodes CEO Steve Hoermann with an update on YieldNodes activities, Decenomy projects, Ukrainian support efforts, the Flits wallet partnership, the upcoming audit, the cryptocurrency markets, passive income, yields, risks and future prospects.

What is YieldNodes

YieldNodes is a comprehensive, multi-tiered, blockchain-based, MasterNode rental program. Revenue is generated through:

- Masternoding

- Price gains

- Services

that all work together to leverage for increased yields within their respective ecosystems.

Since inception in 2019, YieldNodes has grown considerably to also include other areas that stabilize and grow revenue for participants:

- Its own listed cryptocoin, Sapphire

- Its own decentralized exchanges: https://dex.heliobank.net and https://birake.com/

- A crypto-denominated shopping area

- More services, partnerships and business cases that are in development

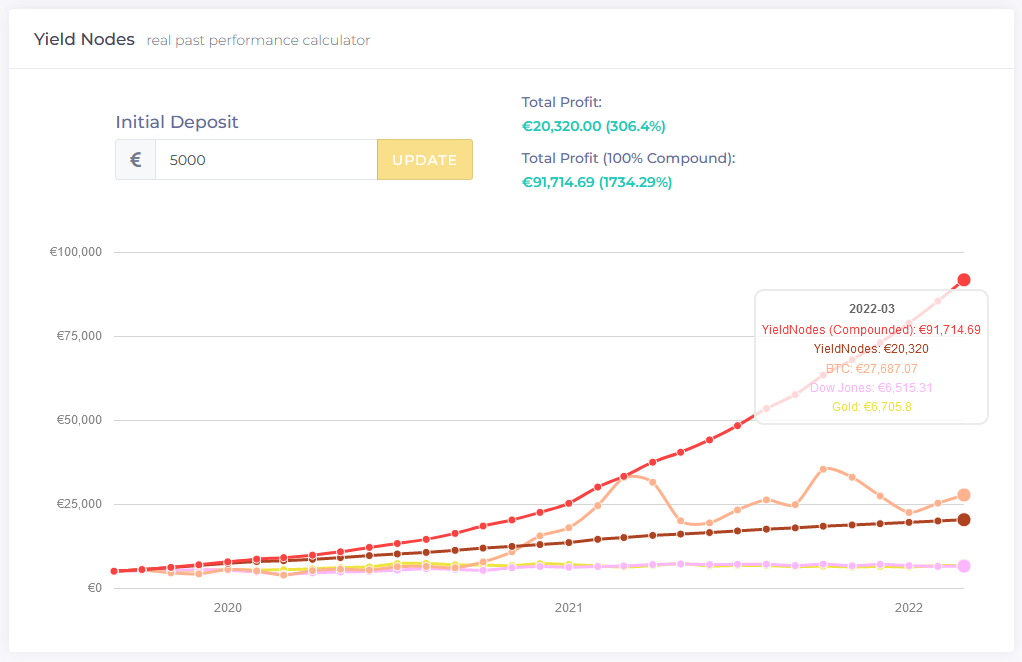

Over the first 26 months of beta-testing and live operations, YieldNodes generated for participants a return of 275.2% despite the pandemic.

What is Masternoding

A Masternode is a server with a unique status in a network that provides special services, validates transactions, and participates in network governance. For providing these services, the masternode earns rewards that creates a commission-like incentive for continuing to provide such integral services.

A master node must lock up, “stake,” coins to gain a master node status. It is basically like putting money in escrow in order to get your status and, later, the rewards. Another way to think about it is like getting a bank loan and offering assets as collateral to secure it.

Masternoding is a very effective way of generating blockchain-based passive income but comes with some risks and challenges if not done properly. Generally, it involves downloading the full node, staking many tokens, configuring the nodes, and connecting them to the network.

To set up masternodes on your own (not required if you join YieldNodes), you must get locked to a specific currency, and the return for each currency varies. The number of tokens required to stake can be very high and cost tens of thousands of dollars. This costly initial investment is itself a risk and often too much for many people to incur.

I’ve written more about masternoding here.

The easier and more affordable option, with much fewer – and manageable — risks, is to participate with a company that has the expertise and experience in masternoding.

YieldNodes is the company I found to partner with to benefit from the lucrative services related to Masternoding while meeting my needs for security of my funds and minimizing risks. Further, the pooled resources of YieldNodes and its members provides for great diversity and stability of its revenue sources, resulting in the increased yields that all members share in proportionately.

YieldNodes Management and Tech Team

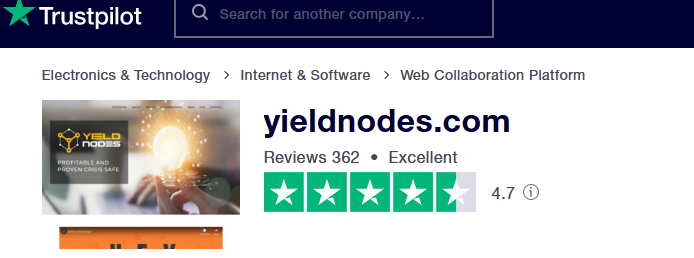

I like the fact that the management is fully transparent in every respect. It appears to be a company philosophy, which engendered my trust and the trust of hundreds of participants. This transparency and success have earned YieldNodes a 4.7 trust rating on Trustpilot.

CEO, CMO, Stefan Hoermann, a 20-year veteran in management and automated finance tools, marketing and crypto/blockchain.

COO, CIO, Urs S., specialist in Blockchain, Distributed Ledger Technology (DLT), Smart Contracts, Programming, Business intelligence/Informatics and IT.

CTO, Yegor Volnyy, 16-years’ experience managing development teams, web design and UX/UI optimization, Forex and Crypto automated trading tools, mobile phone app development and full stack PHP developer.

Partner Coordinator/Tech Support, Dima Tymoshenko, a decade of experience with Smart Contracts, Initial Coin Offerings, (ICO), Blockchain, business development, project management, with a university law degree.

YieldNodes Benefits and Key Features

- Monthly returns, actual and projected, from masternodes of 5 to 15% per month

- The proceeds are shared 85% to participants and 15% to the program (the rental payment).

- If the yield drops below 5% for 3 consecutive months, the rental payment will be returned with any accrued profits

- Total compounded return 1167.09% (since inception in Sept 2019)

- Average monthly yield (last 26 months): 11% – this equates to an annual yield of 132% (or 249.85% compounded)

- Minimum deposit: €500 (~US$565); maximum €250,000 (~US$281,000)

- Minimum term: 6 months

- Deposits can be made in US Dollar, Euro, Visa, Mastercard, SAPP Vouchers, Bank Wire, or Bitcoin from any country

- Yields are paid monthly in bitcoin and can be withdrawn (after 6-month term) or automatically compounded

- Free to join and no membership or subscription fees. Management fees are 15% of the profits and the yields shown are net of any fees taken by YieldNodes.

>> Get Started Today Here: YieldNodes <<

How YieldNodes Generates Returns

YieldNodes makes revenue from the increase in value of the numerous coins in its staking portfolio, with some gaining value, some losing value. Its expertise is in selecting coins that have a higher probability of increasing value, balancing for risk, for its masternoding, thereby returns to its members.

This requires a level of technical expertise to keep the system operating optimally, creating masternodes as proof-of-stakes, and ensuring they run reliably and with operational integrity. Your deposits are pooled with other investors to buy masternodes for various cryptocurrencies. Your funds will be part of over $10million of operational funds. You will get a monthly return based on the profit generated by the portfolio each month.

How YieldNodes Manages and Reduces Risks

All assets fluctuate in value, and this creates risk. Cryptocurrencies can carry more volatility than more traditional asset classes, but this is also where the opportunity lies. Bitcoin, for example, holds the title as the greatest appreciating asset class since its inception in 2009 despite its volatility.

But with those remarkable yields comes increased risk. Putting your money in any cryptocurrency is a risk. The question becomes, how to manage and reduce those risks?

YieldNodes can be classified as a high-risk participation model. It’s important to do your own due diligence before participating.

YieldNodes manages risks by masternoding a carefully researched, analyzed, and selected portfolio of cryptocurrencies so the inevitable volatility is spread across a diverse pool of coins.

At the time of this writing there are 19 integrated projects contributing to the monthly yields.

In additional to pooling funds to create a system of diverse masternodes, the YieldNodes team also invests in the ownership of coins that have real-world usage. For example, their acquisition of Sapphire coin. The coin was about to be dissolved by its developers, but because it had strong community support, YieldNodes took a stake in the coin and became the developers. Because it is a proof-of-stake coin, it is now part of YieldNodes portfolio, which members benefit from.

The team then set out developing the coin and real-world uses for it, like an online store where Sapphire coins can be spent (https://sappshopping.com/products).

YieldNodes saved a dying coin with no use-cases, transformed it into a valuable asset that can grow in usage and value, which added value to the shared masternoding portfolio.

In my view, it’s this entrepreneurial spirit and ability to take action that makes the future of YieldNodes bright and helps mitigate risks. A candid treatment and assessment of the risks can be found here by YieldNodes CEO, Steve H.

Is YieldNodes a Scam or Legitimate Blockchain Platform

With so many scammers out there, one of the most basic acts of due diligence is to determine if YieldNodes is legitimate opportunity for passive income or a scam.

Here’s how I came to my conclusion that they are a legitimate operation worthy of my heard-earned money:

- I spoke with the CEO on a Skype call. He’s a real person with real background that qualifies him to run this operation.

- I checked out the background of the rest of the team.

- I tried to find bad press but only found ones that were promoting other programs, so the conflict of interest disqualified them as objective sources.

- I read every one of the hundreds of reviews on Trustpilot, the vast majority being very positive, 4-to-5-star reviews. Sure, there are some unfriendly ones, but that will be the case with any offer.

- I watched their progress for months before depositing a small amount of USD to verify that they’d live up to their promises. They did; my first month I received a 10.1% return.

- By becoming a member, I was allowed to review their audits, to assess if it is a Ponzi scheme (an investment scam that involves the payment of purported returns to existing investors from funds contributed by new investors). The independent members (not employees of the company) confirmed that the balances held in the YieldNodes ecosystem match and exceed the amount necessary to cover deposits and compounded profits. Near as I can tell YieldNodes is not a Ponzi scheme.

- Like any entrepreneurial endeavor, there is the risk of the principals absconding with the investments. My interaction with the management and their transparency has only increased my trust in their integrity. Further, the team’s share of profits, 15%, is a strong motivator to keep them in the game for the long run.

How Do I Get Started With YieldNodes

Getting started is easy. You do not need any experience with cryptocurrencies to participate, and you don’t need to own any cryptocurrencies to invest because they accept deposits in US dollar and Euros using Visa, Mastercard, and bank wire. YieldNodes will convert your fiat deposits to Bitcoin and contribute to the portfolio on your behalf. You can of course deposit Bitcoin if desired.

>> Get Started Today Here: YieldNodes <<

After your funds are deposited, you can choose to have monthly returns paid out (after 6-month minimum term) or have them compounded by adding them to your balance (after the first month).

Any invested funds, either your original deposit or compounded profits, have a minimum 6-month term. This is because YieldNodes needs that minimum to commit for staking the funds related to your share of the investment pool. So don’t deposit any funds that you’ll need during that period. The monthly yields are paid in Bitcoin. After your funds have been on deposit for 6 months you can withdraw them or leave them to compound. You can also choose to deposit more funds monthly to increase your share and then compound those for greater returns.

Bottomline

YieldNodes has been operating profitably for 2 years as of this writing. They give members access to their audits and are transparent about risks and monthly yields. The platform is a new way of profiting and earning passive income from the new blockchain economy, without having to become mired in the complexities of technical analysis, masternoding, researching and tracking fundamental and trends.

I hope you found value in my Yieldnodes review. Please read more here at the YieldNodes site.

Joseph Giove

Thanks for the thorough review. Upon signing up, they requested personal information including, birthday, ID card and utility bill or bank statement to verify address. Why do they need all this info?

YieldNodes is obligated by the same regulations as banks and crypto exchanges in terms of KYC (Know Your Customer) requirements. It is required by law that they know who they are dealing with to avoid nefarious uses of their platform. I have not had any problems with by inputting all my info.

Thanks for the great interview with Steve!

Good questions, good answers and overall a very good time watching it.

Excellent info above too.

I’ve used Yieldnodes for some time and I think it’s one of the best projects available at the moment. I go to Malta now and then and hopefully I can visit the team when there next time.

Thanks for the positive feedback Corax. I’ve spent a lot of time researching YieldNodes before investing and hope my work benefits others. I’m glad we agree that it’s a solid project. I admire the YieldNodes team and how they approach this market. Maybe we’ll see each other in Malta this year…

Hi Joseph,

Thanks for your review. I was wondering if you could tell me how Yieldnodes is faring during this market, especially if it suffers from the same issues as other “nodes as a service” projects such as DRIP and STRONG. It seems their tokens continue to lose value. Also, how do you deal with taxes with the monthly compounding since you are in the US?

Thanks,

Michael

Hi Michael,

YieldNodes has about 19 projects upon which its yields are based, some masternodes, others, its own managed coin, Saffire, some its DEX managed exchanges. Each are managed projects that also take advantage of market volatility, demonstrated by returns of 8.3% in February, and 1.8% and 2.0% respectively for first 2 weeks of March. Third week returns should be out shortly. I, personally, obtained 40% return on my crypto swing trades in February, so Steve, Urs and the team no doubt have better skills at managing the member pool than I.

As far as taxes, 2021 was my first year with YieldNodes, so am in the process of filing now. I downloaded a detailed report of my investments and the compounding and sent it to my CPA. I have yet to see how he suggests handling it. It’s a great question though because they are not technically realized gains yet, but I am not a CPA or lawyer and cannot give legal or tax advise here. If you PM me through my contact page we can discuss it further.

I hope this helps.

Joseph

Hi Joseph,

Great content, im still doing my own due dilligent research;)

Have so far only the following questions:

1. As the contributors money is converted to btc and then converted to 1 of the 19 cc projects. The main risk is that when a heavy downturn/marketcrash occurs, the value of those 19 all together are gonna be lower than the total amount of what all contributors have invested. Imo

Is it known/is the info available when this cross will occur? (Like total is currently x% above total invested amount)

And what would happen if this would occur? Because basicly they cant pay back each contributor its investment at that moment, right?

Pleased to know your thaughts on this

Br

Sander

Hi Sander, great question. Let me answer best I can. I will know more after my participation in the audit this May 2022.

Their projects include masternoding of 19+ projects, two decentralized exchanges, a white-label exchange, their own tokens (Sapphire), Flits wallet, and more projects on the horizon. The yields that members share in is income from all these projects. Sure, masternoding coins requires certain liquidity to cash out which may be impossible to cash out if the entire crypto market crashes.

But in the last 6-7 months, with Bitcoin’s 50%+ crash, YieldNodes still paid out 8.2% monthly average, 5.6% so far this month, and 2% last week. This shows me a certain resistance to market fluctuations, even as big as the last one. There may be a larger correction in the future, which is why Steve and Urs (and me) always encourage diversification into other asset classes. Of course anything in crypto is high risk, and from my experience over the last 7 years playing in this crazy crypto space, it’s the people behind the projects that create the stability and/or risk. I’ve lost more money in crypto from low integrity or pain bad team management than in market fluctuations. That’s why I value the YieldNodes transparency…first crypto project I been in that allowed average members the opportunity to peek under the covers through their regular audits.

In the end though, it is risky, but I don’t lose sleep over the minimal chance of a 95%+ crypto crash. I suspect if that happens, other markets will be suffering too, so where to go, gold, commodities?

Thanks for your thoughtful questions.

Joseph

Clear, logical and inteligent YN review. Thanks man!

Me to I was shufling my feet for few months before I got involved with my first 500e. Now, after 18 months with YN, I can’t still believe these guys are so good. I just love it. It increase my investment nicely and I putting more money enytime I have some to spare. End of April 2022 I should reach my first goal of 5,000e. Next step is to go for 10,000e. When I reach that, I can retire with 1000e month. In my country it’s almost 2 month wage 😉

Actually what got me started to write was the coment to diversify. Frankly, I have no idea what can I diversify in to. The YN are the best, safe and good return.

All the best wishes to you all…….happy YN 😉

That’s great George. Wonderful to see how you parlayed your initial investment into a 10X return. Keep it up and do look for ways to diversify, even if it doesn’t match YN returns. It’s still a good practice in portfolio management.

Joseph, can yield nodes partner with people from US who want to invest a good amount?

Yes, Sarvesh. It’s best to discus this privately. Please contact Contact me with your details and we can chat on the phone.

Hi Joseph

An extremely interesting review, thank you!

I’ve been looking to get started with Yieldnodes and I understand the terms regarding the fact that you may not withdraw profits until after the initial 6-month term is up. However, if I decide to make a small initial deposit (say $1000) in the first month, and then add another deposit (say another $1000) in month 3 if I am happy with the way things are going. Would it still be possible to withdraw the cumulative profits of both deposits after month 6?

Hope my question isn’t too confusing! 😀

Many thanks!

Hi Norton,

I am glad you found my review helpful.

It’s a good question. The 6-month hold period applies to all deposits and also to any reinvested funds. Each deposit or reinvestment starts its own 6 month withdrawal limit. So additional investment in month 3 would start the 6 month period from then to withdraw.

I hope this helps.

May I simply just say what a comfort to uncover a person that actually knows what they’re discussing over the internet. You actually know how to bring a problem to light and make it important. More and more people have to check this out and understand this side of your story. I was surprised you’re not more popular because you most certainly possess the gift.

Thank you for your kind words. I am glad you found my review useful.

Excellent review Joseph, greatly appreciated.

I’d be curious to hear your thoughts on what would happen to Yield Nodes would the “crypto winter” we’re supposedly about to enter last 1-2 years?

I understand they’re diversified, but it remains mainly altcoins, which took an average drop of 30 to 75% during the last month crash . Then there’s the 6 month hold, which prevent in part from panic selling/opt-out, but still, it doesn’t last forever.

Do you know if they keep part of their balance sheet in Fiat currency?

Thanks Pierre.

I don’t know what would happen with a prolonged crypto winter. I am not sure Urs would either, but I will ask about their contingencies for extended bear markets when I am with the team in Malta in about 3 weeks.

Same goes for the fiat in their balance sheet. That is one of my questions I hope to get answered during the audit.

Ping me again beginning of August and I will hopefully have answers to these excellent questions.

Great review and also great questions in your AMA calls with Steve. I was wondering what you feel about using YN via a SDIRA (with LLC) and how it would affect the tax. Would it fall under UBTI since its an investment in a company, or would it be considered a loan (since you lock it up for 6 months) which pays out interest. Or would it be considered investing in a corporation (e.g. CCORP in the US) which wouldn’t trigger UBTI either… Let me know your thoughts.

Thanks Jim.

Great question but I’m sorry I cant help with them. Sounds like a tax attorney would best best for those answers.

Good luck!

Thanks a lot for the blog article. in reality Great.

Thank you Catherine. Glad you found it useful.

HI Joseph,

how would you rate the current situation? Exit Scam or…?

Thx

Neither, Shatavy.

It’s a redistribution of assets and reorganization. If you are a member, the best action now is to support their strategy. Join the Facebook Group, watch all the video updates that Steve is doing. Look for ways you can help. If it was a scam, they and your money would be long gone. They are still in the game, trying to what’s best. Be patient.