Is it a coin worth paying attention to in 2022? Is the Solana ecosystem something that we should all have our eyes on in 2022?

What is Solana? What’s the token doing?

What’s happening with the NFTC? What are the big statistics on change we need to know?

What big partnerships come next? What challenges has Solana been facing?

What is Solana?

Solana is a smart contract platform so much like Ethereum. It is a blockchain, and a token runs on top of it. Solana uses something called proof of history which is a different consensus mechanism. Other blockchain use proof of stake while Bitcoin uses proof of work.

With proof of work, lots of computers do all of the work to validate transactions on the network. Solana is using proof of stake so there are a small number of validators that allow the network to have massive transactional throughput. Something like 50,000 transactions per second are possible on Solana.

If it is compared to Ethereum now, Ethereum does around 15 transactions per second bitcoins. There’s lots of other blockchains out there that are doing some pretty great transactions per second, but at 50,000 transactions per second Solana is definitely a top tier blockchain in terms of huge amounts of potential throughput for the blockchain.

What is the Solana token?

So there are two primary use cases for the SOL coin. Solana is used for paying gas fees on the network and gas fees are dirt cheap on Solana. Even very complex things can be done on Solana for a penny. Sending Solana or sending stable coins or tokens around costs just basically nothing. It’s super cheap to use the Solana network. The token is used to pay for gas on the network.

The second thing Solana is used for is for earning a passive income. Solana can be staked using a popular wallet like the Phantom wallet, for example, and earnings are around 5 to 6 % apy. It might be easy to find better rates than just staking but staking is simple, safe and easy to do on the Solana network. 5 or 6 % is a decent rate of return paid out in an asset that may appreciate much in value in the future.

What is the Solana ecosystem?

Key things that you need to know:

Solana has been a very popular blockchain with the big money funds. Venture capital has massively backed the Solana network: 5 new funds bring $100 million to boost growth of the Solana ecosystem.

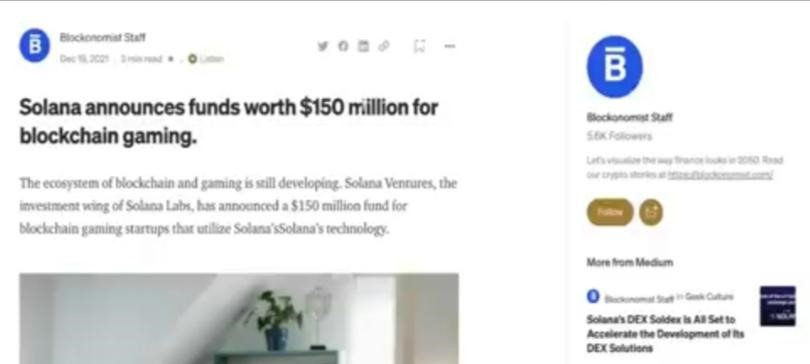

Maple finance deploys $45 million to support the Solana ecosystem and Solana announced a $150 million blockchain gaming fund at the end of last year.

There are 10 other funds that have been announced for the Solana blockchain. Hundreds of millions of dollars of venture capital money has come in to back the Solana blockchain, plus the support of FTX, one of the biggest and most prominent exchanges in the crypto currency space owned by Sam Bankman-fried (one of crypto’s top net worth billionaires). So there is a big amount of money behind Solana blockchain betting on its future success.

The total value locked in the Solana blockchain is at $6.5 billion currently.

It has come down dramatically since its days when it was up around $15 billion (60% decrease). The same has played out across most blockchains where many have seen 40, 50, and 60 % down turns in their total value locked on chain. Still, six and a half billion dollars is a heck of a lot of money sitting in Solana-based decentralized finance applications.

It’s also in all of the famous applications: Marinade, Solend, Raydium etc., lots of well-known names here in the Solana ecosystem.

Solana currently is the fifth biggest blockchain by total value locked. Behind Avalanche, BSC, Tron, Terra, and Ethereum but ahead of others like Fantom, Tron, Polygon, Cronos, and Arbitrum. It’s doing pretty good even with a lot of competition.

It can be seen moving up and down in the charts but Solana has been in the top 10 for a very long time. It’s usually in the top 5 by total value locked.

There is a very interesting statistic as well, the seven day active addresses by chain from Nansen.

It’s not a completely exhaustive list. There are some very big blockchains that are not being tracked on this list. But regardless of that, 3.72 million active addresses for Solana is a massive amount. It puts it ahead of the Binance smart chain, Polygon. and Ethereum.

Solana is getting incredible use right now. A lot of people are paying attention to the Solana blockchain currently and the users are showing up. This is an important metric to be keeping an eye on because if the users are not showing up, it’s problematic. But in the case of Solana, the users are showing up big time. The NFT scene also has really taken off on Solana.

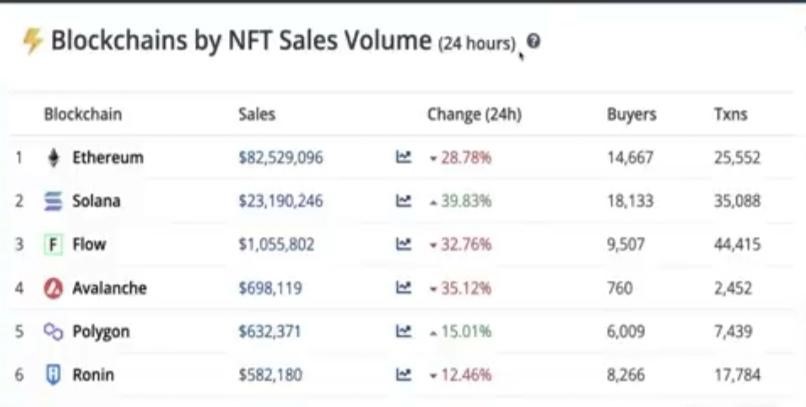

There are a few different metrics going around but it appears that the sales of NFTs on Solana reached $23 million. People are going crazy for and buying up huge amounts of Solana, around 8 to 10 million dollars a day of NFT sales which puts it at about one tenth of the average daily sales on ethereum total sales.

There’s just so much interest in Solana based NFTs that Solana has become the second biggest chain for NFTs even with competitors like Avalanche and Polygon. Cardano and Terra didn’t even make it to this list.

Solana nailed the number two spot and is well ahead of the third one on the list. The interest in Solana-based NFTs has been big. There have been a lot of great collections launching on Solana, whether it be the Solana geckos or the dragons that launched. Both are very popular and very high value collections. Gaming NFTs that are coming out on Solana are capturing a lot of public interest as well.

Solana’s NFTs also have now started trading over on Opensea. Opensea, the biggest NFTs marketplace in the world, integrating with Solana NFTs is definitely a great thing.

Magic Eden, the sort of native Solana NFT marketplace, has maintained very strong volume levels compared to the Solana trading happening over on Opensea. So a lot of users are staying with Magic Eden instead of coming over to Opensea. However, in the long term Opensea will bring in more eyes to Solana NFTs and more people to the Solana network.

This is an updated list from the guys over at Solanians. They regularly post these ecosystem updates. This one was updated about a month ago. Wallets, tools, explorers, applications, and all the stuff on Solana right now can be seen here. There is a lot of experimentation happening on the Solana network.

There are also infrastructure stable coins development kits, staking bridges, DAOs, and NFT marketplaces as well. Gaming is a big force on Solana. Many games are launching on Solana and many more are planning to launch.

There are some games launching on Ethereum, on Polygon, and obviously BSC is very popular but a lot of new games are coming to the Solana blockchain. There are very high potential ones that have already been announced and lots of others that are coming in the not so distant future.

And of course, the one that is really getting everybody talking right now is STEP’N now.

STEP’N has had 35,000% gains since the token sale. The whole move to earn thing has exploded and STEP’N is definitely providing a lot of business right now for the Solana blockchain with daily active addresses and NFT sales and stuff like that coming into STEP’N and bringing them into the Solana blockchain.

There are also some pretty big integrations like the launching of a Solana exchange traded product. These are things that one can buy on a brokerage account depending on the country. Grayscale investment launched the Grayscale Solana trust late last year.

CME group is considering offering both Solana and Cardano trading futures. Currently, CME has only offered Bitcoin and Ethereum.

They are looking at the next big things, and where the demand is. They know Solana and Cardano are huge. This is why they are looking to offer some sweet trading contracts. The CME trading contracts are absolute garbage but it does show a level of institutional interest in these assets.

Everything is not perfect in Solana land though. There was a very infamous attack that happened a couple months ago. The wormhole bridge was hacked for $320 million worth of Ethereum.

The wormhole was a bridge between the Solana blockchain and the Ethereum blockchain and the hacker cashed out a lot of money from that bridge. Bridge hacks have happened to most bridges at this point, whether it’s built on Solana or Ethereum or wherever else. There’s been a dozen bridge hacks in the last year. It’s a very difficult crypto technology which has been a big attack vector for attackers.

Solana had some little outages earlier this year which was problematic for a lot of reasons.

There would be times when basically Solana would be unusable because the block change is kind of whoopsies, which is not a good thing at all. People start talking about financial stuff like who are going to be liquidated because they can’t get access there, defi, loan, or whatever it might be. Then they start talking about the blockchain not functioning in a way that is literally destroying some investors. We need to remember that this is still new technology. There are still a few wrinkles being ironed out in the Solana blockchain and these outages were a big hit in terms of Solana blockchain. So that’s something to keep in mind when thinking about Solana. There has been a little bit of drama happening with the blockchain.

Now let’s take a look at what’s coming up looking forward to the future of Solana.

For example, Coinbase recently started to list Solana based project tokens starting off with ORCA, which is one of the biggest decentralized exchanges on Solana.

It was announced that they’re listing the STEP’N tokens. So both of the STEP’N network and tokens for that sweet move to earn an app. This brings more liquidity into the Solana ecosystem and allows a wider variety of people because Coinbase has around 90 million registered users. It’s a lot of potential exposure to these assets.

There is also Solana Pay coming up. It’s one of these things that they hope is going to be the next big innovation in payment processing.

Facilitating payments while taking NFTs and web3 into account, making this new payment protocol to be the Visa or the PayPal of web3 is what they’re aiming for with 50,000 transactions per second. An even higher theoretical limit present an interesting opportunity for blockchain based payments.

The Bank of America is out here saying that Solana is becoming the visa of the digital asset world.

Solana does have more technological innovations coming out as well. This article includes some of the challenges Solana has been facing and Solana is sort of in-beta still. Even though all the features are here, they are still trying to improve a few things moving forward.

Solana still has a huge amount of potential. Solana has a very bright future. Crypto games on Solana network, crypto defy on Solana network, NFTs on Solana network, all this stuff is going to continue to take off in a very big way.