It was one of the biggest economic surprises of the year so far, a first quarter fall in U.S. GDP. Some claimed that this was a minor technicality, others think that a recession is inevitable. This article will highlight what’s going on and analyze which way the economic winds are likely to blow.

Before talking about GDP, there’s something to know about little. Let’s take a look at this looming recession.

Let’s start with GDP decline. It came as a bit of shock. The U.S. first quarter growth turned out negative out negative at -1.4%.

This followed a pretty steady 6.9% growth rate at the end of last year. Moreover, this was far below the median analyst projections which had Q1 GDP growing at 1%. Now despite how gloomy this would have made most people, the markets seemed to rely on the news. This had many people scratching their heads, wondering what the hell was going on. It could be because people thought that the reason for this fall in the Q1 numbers was more technical than anything fundamental. So what does that mean?

We had a negative change in inventories and a large fall in net exports. The trade subtracted 3.2% from GDP whereas the former was 0.84%. If we’ll run the numbers, we’ll arrive at the -1.4% that we got for GDP.

According to the press release from the bureau of economic analysis “The decrease in real GDP reflected decreases in private inventory investment, exports, federal government spending, and state and local government spending, while imports, which are a subtraction in the calculation of GDP increased”.

Now what this could imply is that one of the engines of U.S. economic growth, consumer spending is still quite strong, whereas all the other factors that could impact on that GDP collection were weighing down on it.

So does this adequately explain the fall and is it much to do about nothing?

IN short, yes.

There was a large drop in government spending this quarter on account of limited stimulus. Moreover, because the U.S. consumer demanded a great deal of goods in the first quarter, they had to be imported. On the flip side though, consumer spending in other countries and particularly those in Asia has been lower.

That means that the U.S. was not importing more than it was exporting in the first quarter bigger gap in net exports. On top of this, investment has fallen because inventories have fallen as well.

While there was a large stock of inventories in Q4 of last year, U.S. consumers have voraciously worked their way through that this year.

Moreover, given supply chain issues, companies in the U.S. have not been able to easily replenish these stockpiles. So on the face of it, it appears as if the core of the GDP calculation which is consumer spending is holding up better relative to other countries around the world and hence the reason for that trade imbalance. This then led many analysts to claim that the numbers did not concern them and they still saw strong U.S. growth this year.

For example, Gargi Chaudhri, of Blackrock ishares investment said “I would also say that when we forecast second and third quarter GDP, I think we are going to see some of the draws from government spending and from net exports that we saw in the first quarter probably point to a more resilient U.S. economy”.

Let’s not forget the infrastructure bill that was passed last year in congress.

These massive government spending packages don’t happen overnight and the funds take at least six months before they start going out, that means that we may not have seen the effect of spending last quarter, it may come in this quarter.

Also if it is believed that supply chains are likely to ease up more on that in a bit, then you can expect those net exports to also normalize.

Now similar arguments were made by Ian Shepherdson, chief economist at Pantheon macroeconomics “This is noise; not signal. The economy is not falling into recession”. He went out to point out that net trade imbalances could actually boost net exports in Q2 and Q3.

Gus Faucher, of PNC financial services said quote “The U.S. economy is not in recession. A few temporary factors trade inventories and government caused the economy to shrink”.

Indeed the broader collective of Wall Street analysts don’t think that we’re heading for a recession anytime soon.

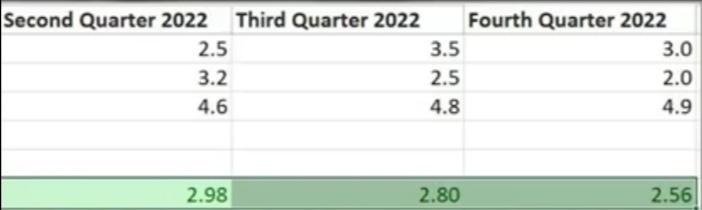

That’s thanks to this Handy Wall street journal economic survey for April.

It asked a total of 77 economic analysts, their projections on the number of key variables. One of those was economic growth and the average estimates were 2.9, 2.8, and 2.56% respectively.

That’s because many appear to be basing their assumptions on historical norms which are quite frankly not fit for purpose in the current economic climate.

That’s because right now inflation is at levels that we have not seen for over 40 years.

Inflation that appears to be still on the rise and is showing no signs of slowing down. This inflation is of course destructive for everyone’s wallet but it’s less likely to cause a recession than the methods used in order to rein it in.

The Fed has been favoring one side of that dual mandate growth at the cost of some seriously high and destructive inflation.

So in order to try and rein in that inflation, the fed has to dramatically reverse course and start raising rates. In fed parlance, it’s trying to achieve a quite soft landing essentially guide inflation down with higher interest rates without damaging the economy.

The only problem is that asking to trying to land a jumbo jet on an aircraft carrier. It’s more likely to be a crash that overshoots the deck.

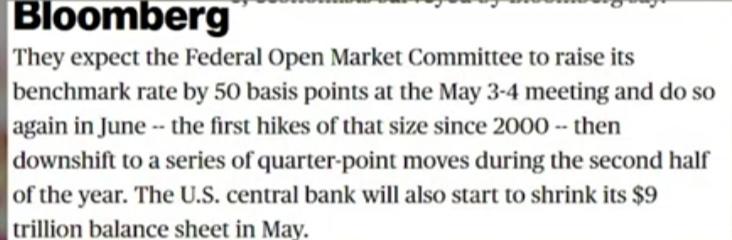

The fed started this reverse course towards the end of last year when it began tapering its bond buying this taper sped up this year and resulted in the very first interest rate rise in March of 25 basis points.

The fed is currently having its May meeting and the market expectation is that it could raise rates as much as 75 basis points.

Even the lowest estimates of 50 basis points is still quite significant given that the previous hike was only 25 basis points.

Now of course, raising interest rates does not come without risk that’s because when the fed raises the base rate, fed funds rate, interest rates throughout the economy also go up.

Higher interest rates mean lower growth because people are less likely to take out loans, companies can’t take out loans for investments. It could also lead to severe stress as people and companies that have taken out debt now have higher interest payments to make.

The point is that because the fed was subsidizing its growth objectives during covid at the expense of inflation. It now has to go other way and severely restrict that money supply.

The only problem here is whether these fed actions can really have any sort of impact on inflation.

That’s because one of the biggest drivers of our current inflation is outside control of our fed and that is cost push inflation or more specifically supply chains and energy prices.

If the war in Ukraine is unlikely to end soon nor the accompanying sanctions.

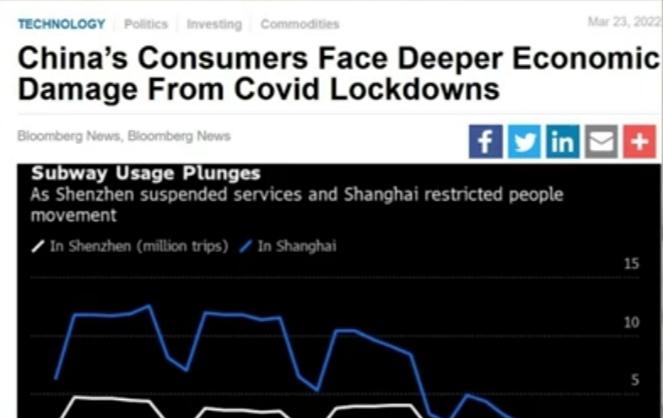

But also the Chinese government appears unrelenting in its lockdown policies.

For example, shanghai population (28 million people) is entering its fifth week of lockdown. And while there have been some hints that it could be eased people in the city have not yet felt any reprieve.

Beijing now appears to be at a tipping point as some apartment complexes appear to be getting locked down.

More venues are being closed and restrictions put in place. Right now, it’s not a matter of if but when Beijing is going to go into a hard lockdown.

Now the impact that these policies have had on the Chinese economy is hard to tell. That’s partly because the lockdown started at the tail end of Q1 and partly because their numbers can’t fully be trusted. But there are already some indicators that things aren’t likely to look good.

That’s thanks to the April manufacturing and non-manufacturing numbers which show a massive fall over the month.

According to a statement by the statistics bureau, the deterioration in manufacturing activities was due to declines in both productions and demand. So it’s quite clear that china’s GDP is in for a nasty shock.

Even if the government stats are able to miraculously show some growth. The impact that these lockdowns are having on the rest of the world is profound.

Firstly, given that slowdown is in demand as well. This means that Chinese consumers are less likely to be buying western goods.

Net exports are impacted by the amount of goods that are being imported in these regions.

This further weighs on the GDP numbers in the second quarter.

Then, of course, the impact comes that these lockdowns are having on the production and distribution of those goods. China’s closure of these ports and restrictions of truckers coming into coveted hotspots is having an incredibly destructive impact.

There is a risk that when these lockdowns do eventually lift, there’s going to be a barrage of orders from companies in the west that are wary of running out of inventories. This is likely to flood western ports with a crush of imports once again.

According to Jacques vandermeiren, the chief executive officer of the port of Antwerp “we expect a bigger mess than last year. It will have a negative impact and a big negative impact for the whole of 2022”.

So what does all of this mean?

Disruption of manufacturing in china and also in the west on account of limited supplies for one thing. You then also have that immense cost push pressure on inflation, the higher inflation goes, the more fed will have to tighten, the more it hammers the economy a triple whammy. But of course, china’s lockdowns are not the only risk weighing on the global economy.

We are now in the third month of Russia’s invasion of Ukraine and to say that it has been a disruption is putting it mildly.

Not only invasion has itself completely destroyed Ukraine’s economy, to say nothing of the suffering inflicted upon its people.

But the sanctions against Russia are likely to send it intodeep recession too. In fact, those sanctions are likely to cause even more global economic damage than the conflict itself.

Russia is starting to make good on its promise to stop sending gas to those countries that don’t pay for it in roubles.

And the first two countries to have experienced that are Poland and Bulgaria when Gazprom recently turned off the tabs.

Europe cried foul and screamed blackmail which it no doubt was. But as long as they are dependent on that gas they can’t say much more. About a quarter of Europe’s energy generation is thanks to gas and about 40% of that comes from Russia.

This recent action by Russia and the looming threat of further blackmail has been weighing on other countries that could be in the firing line.

Countries are trying to adapt and wean themselves off Russian gas. However, many fear that this cannot be done fast enough. If there is a situation in which Russian gas is turned off for the rest of Europe, then the unthinkable gas rationing is likely to take place.

Industries will have to lobby governments in order to make the case as to why they should be allowed to receive gas over homes and other businesses. Companies will go under. If this story plays out then it will be hard for Europe to escape a recession.

According to the Bundesbank, Germany’s central bank “In severe crisis scenario, real GDP in the current year would fall by almost two percent compared to 2021”. Naturally this is not good for Europe but it’s bad for the rest of the world too.

A slowdown in Europe means less demand for U.S. goods and hence a worsening in the trade balance and GDP also.

We cannot forget the impact that an oil and gas embargo will have on the prices of these commodities.

Countries in Europe will be scrambling to make up the shortfall with imports from other regions. This will, of course, push up prices for everyone around the world.

This will result in more inflation which the fed will have to fight with policies that impact on growth. It’s not at all unrealistic to assume that we could be heading for a period of low growth and high inflation i.e. stagflation.

Not since the 1970s, have we seen this economic reality play out a reality that no one thought likely until a few months ago. So are we heading into a slowdown or even possibly a recession?

Here are views of others about this quagmire.

Let’s start with perhaps one of the most well-known global financial organizations out there, IMF. It has recently slashed its growth estimates for the region and warned of severe economic consequences for Europe given the ongoing war.

This has forced it to lower its growth forecast not only for the region but also entire global economy. This was part of its global economic outlook report published about a week ago.

And speaking of the IMF, one of its ex-chief economists seems to think that we are at serious risk of falling into a recession.

Kenneth Rogoff, is a well-known Harvard economist and he made this case in a guardian op-ed. He thinks that the risk of a U.S. recession has recently soared with the main uncertainties now being its timing and severity. He also thinks that China’s zero covid policy is causing significant economic damage and it could already be in a recession. As it relates to the old continent “a recession in Europe is almost inevitable if the war in Ukraine escalates scary stuff”.

Another important perspective on this is that of Bill Dudley, an ex-federal chairman, he recently wrote in a Bloomberg op-ed that “the fed has made a U.S. recession inevitable”. In the piece he takes swipes at current fed policy and thinking.

One thinking is that they had no impact on high levels of inflation that we currently see and yes it does still think that. And the others think that it can somehow engineer a soft landing because of similar episodes in the past.

Dudley claims that “the fed’s application of its framework has left it behind the curve in controlling inflation. This in turn has made a hard landing virtually inevitable”.

Now another report is from Deutsche Bank. In it db’s chief economists warn that the U.S. is on the brink of a major recession and that it will be much worse than expected.

They said “we regard highly likely that the fed will have to step on the brakes even more firmly and a deep recession will be needed to bring inflation to heal”.

They also estimate that in order to significantly bring inflation down to those target two percent levels, the fed’s fund rate will have to rise to at least the five or six percent level. For a world that’s already so indebted such a measure is not likely to end well.

What are all investors saying?

A survey that polled over 1200 major investors worldwide, it was conducted over the first few days of April. What the survey finds is that, a worldwide recession could be just around the corner.

Moreover, according to the sentix economic indicator, investor confidence in the Eurozone is now at its lowest level since the early days of the pandemic.

But perhaps one of the most illuminating surveys about a potential recession is that which polled 4,000 adults in the U.S.

According to the survey, a full 81% of the respondents say that they think the U.S. is likely to experience a recession this year.

Moreover, the vast majority of those surveyed said that they are worried about this recession. Now what do people do, if they are worried about economic hardship. They save, they slow their spending which, of course, ends up further impacting economic growth. If consumer sentiment does eventually sour, that could be a further drag a GDP. Remember that the consumption part of the GDP calculation was the one that everyone was trumpeting earlier. Less consumption, lower GDP and a recession bake some inflation into that equation.

Some thoughts are; the negative Q1 GDP numbers were no doubt a shock when the consensus estimate is for 1% growth and you’ve a 1.4% contraction that’s sure to ring alarm bells. There were some large adjustments to the net exports and investments but they are still an important component. Moreover the assumptions that these are likely to reverse themselves in Q2 are hopeful at best.

Given everything else that’s going on in the world right now demand for exports is likely to be muted and supply chains are only going to get more strained. Not only this will have a negative impact on output and consumption but it’s also going to add further pressure to inflation. Inflation that is frankly out of control, the fed is going to have to try and rein it but it’s between rock and a hard place. Does it risk a recession with severely restrictive monetary policies when a great deal of price pressure is coming from something that it can’t control?

It will be hard to stave off a recession. Europe seems poised to enter one given that Putin is not interested in ending the war and wants to settle scores. China is probably already in a recession and even if it isn’t, you’ll want to take its official numbers with a truckload of salt and then you have U.S. consumer confidence which could likely be further harmed by high inflation, low growth, and higher interest rates.

So the main question now appears to be not if we will head into a recession but when?