ETHEREUM

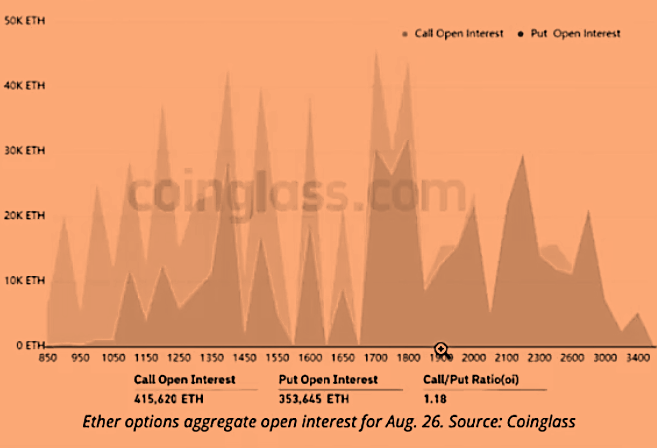

On August 26, $1.27 billion in ETH options expired, and data signals that the price is likely to stay pinned under $2,000 until the Merge.

Bears placed their bets that Ethereum price will be below $1,600 after the expiry.

Bulls have a few different scenarios but even they aren’t betting that Ethereum is going above $2,000 anytime soon so nobody’s ultra bullish yet nobody’s ultra bearish.

If we look at call options vs put options, call open interest, which is IE bullish or Put open interest, which is bearish, there are more calls than puts with a call put ratio of 1.18. So the bulls are winning.

In a nutshell, that means because the price of Ethereum right now is above $1,600 and the bears place their bets mostly below $1,600, if Ethereum’s price remains above that number at 8:00am UTC on August 26, only $95 million Put (sell) options will be available. This difference happens because a right to sell Ethereum at $1,600 or lower is worthless if it trades above that level on expiry.

Again it tells that the Bulls are winning. Bulls completely dominate the August expiry.

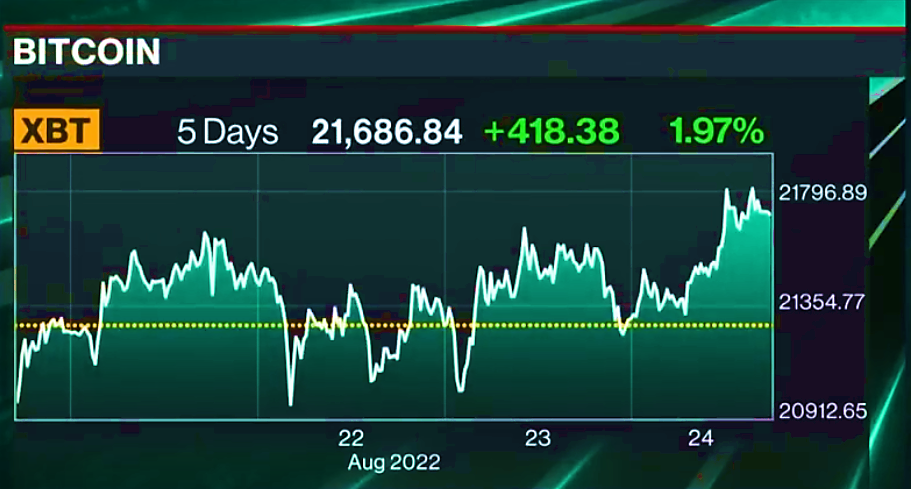

Will Bitcoin Go Up or Down in September?

On Bloomberg, VALKYRIE’s chief investment officer gave his opinion saying:

“As long as the Fed is still hawkish, risks of assets like Bitcoin will continue to get drained”.

He also added that Bitcoin has a little bit further to fall from where it is today.

“It’s pretty close to the bottom and from here, in the long run, it’s going to be doing just fine. But everything depends on macro at the moment, inflation, as well as what risk assets do in a hawkish Fed. Anytime that liquidity is being taken out of this system which is what’s happening right now, all risk assets will continue to fall. So Bitcoin luckily and also, unfortunately, earlier this year, did fall quite a bit due to some local contagion risks. But Bitcoin was the first asset to go. There is waiting for the rest of the financial markets to catch up. There is a lot further to go as far as rate hikes. We think we’ll see the Fed target rates somewhere between 375 and 400 by the end of the year.” – Steven McClurg, Valkyrie, Chief Investment Officer

Uniswap Forms Uniswap Foundation

It became reality after 86 million votes in favor. The $74 million plan allocated to this foundation was proposed by two former Uniswap Labs executives.

What is the purpose of this foundation?

According to the initial proposal, the foundation aims to streamline Uniswap’s Grant Program (UPG) and reduce friction in the protocol’s governance system.

Former Uniswap Labs executive Devin Walsh, now serving as executive director of the Uniswap Foundation, shared the results in a tweet on August 24, noting that the proposal to create the foundation “passed its final vote”.

Walsh said that Uniswap has already “hit the ground running” on its top priorities, including interviewing “talented, value-aligned candidates” to join the team, scaling up the UPG, and “reinvigorating governance.”

Algorand Makes Strategic Investment

The foundation behind Algorand has made a strategic investment. Opulous announces key investment from Algorand Foundation.

What is OPULOUS?

OPULOUS was among the first companies to open music investments to everyone. Now a year later, they’re continuing to deliver on this promise making the power of MFTs (Music Fungible Tokens) accessible to artists anywhere in the world.

Why did Algorand choose to invest?

“Ditto Music’s history, (the company behind OPULOUS) as a music disruptor speaks for itself, and the team has done it again with OPULOUS. Algorand’s scalability will allow OPULOUS to grow aggressively. At Algorand we believe in sustainability in everything we do, including the growth of artists and creators, and we know OPULOUS shares the sentiment.” – Micah Adams, Creative Director, Algorand Foundation

SHIB Jumps 9% As Token Burns Intensifies

SHIB is the 12th largest cryptocurrency, and has a market capitalization of over $8 billion and currently trades at $0.00001439.

Its upwards price action is primarily a result of a spike in the token’s burn rate earlier this week, and expectations around the launch of Shibarium, a layer-2 blockchain to be launched by Shiba Inu.

Nearly 110 million SHIB tokens have been burned,, and 40% of the total SHIB supply has been burned to date.

Polygon Founder Raises $50m for Web3 Fund

POLYGON founder Sandeep Nailwal raises $50 million for a Web3 fund. Nailwal’s venture firm, Symbolic Capital is backed by cryptocurrency protocols, exchanges, crypto-focused auditing firms, and other venture capital investors.

Why is this significant?

Symbolic’s fund has already invested in three blockchain-focused gaming startups:

- Blink Moon

- Planet Mojo

- Community Gaming

Even though prices are going down, coins are consolidating.

Smart money is taking out its positions in Web3 today, and thinking long term.