In cryptocurrency, there are ways to profit. Some buy low and sell high. Others mine, using computers to solve puzzles and earn rewards. But there is another way: staking.

Staking is locking up “crypto” or cryptocurrency to support a blockchain network. In return, you earn rewards in the form of more cryptocurrency. It’s like planting a seed and watching it grow.

This article will explore crypto staking. We’ll explain what it is, how it works, and why it’s important. We’ll also provide a guide to help you get started. So let’s dive into the world of cryptocurrency staking.

What is Staking?

“Staking” in cryptocurrency is the process of locking up or holding a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network that uses a Proof-of-Stake (PoS) consensus mechanism. In return for staking their crypto, users are rewarded with more cryptocurrency, typically in the form of interest or dividends.

Staking Crypto vs Mining Crypto

Staking is an alternative to mining, which is the process of using computational power to solve complex mathematical puzzles and validate transactions on a blockchain network that uses a Proof-of-Work (PoW) consensus mechanism. While mining requires specialized hardware and consumes a significant amount of energy, staking is less resource-intensive and can be done by anyone with a compatible wallet and a certain amount of cryptocurrency.

In a PoS-based blockchain network, the right to validate transactions and create new blocks is determined by the amount of cryptocurrency that a user has staked. The more cryptocurrency a user has staked, the higher their chances of being selected to validate transactions and earn rewards.

Simply put, one may use computational power to earn rewards in crypto (PoW), or one may lock their crypto for a certain time period to earn that reward (PoS). However, this will be examined in more detail.

How staking helps maintain the operations of a PoS-based blockchain system

Staking helps to secure the blockchain network by incentivizing users to hold and lock up their cryptocurrency, rather than selling it. This reduces the circulating supply of the cryptocurrency and helps to maintain its value. Staking also helps to ensure that the blockchain network runs smoothly by providing an incentive for users to validate transactions and support the network.

Overall, cryptocurrency staking is a way for users to earn passive income from their crypto holdings while supporting the operations of a blockchain network. Due to the aforementioned electronic costs associated with Proof-of-work, some blockchains function entirely on the Proof-of-Stake model. Hence, staking is an integral part for currencies like Cardano, Solana, Ethereum 2.0 etc.

How Does Staking Work?

Crypto staking only works with cryptocurrencies that run on proof-of-stake, and differs from its proof-of-work counterparts, like Bitcoin, in its energy-efficient approach.

To stake crypto, you must obtain the desired cryptocurrency through an exchange, such as Coinbase. So, if you want to stake Ethereum, you must sign up to an exchange and buy Ethereum.

Once in, a sum of the currency is staked on the blockchain. Upon each addition of a new block, a stake is chosen to validate it, and in return, the validator receives a reward in the form of freshly minted cryptocurrency.

Size matters when staking, so the more you stake, the higher your potential gains. The system favors the weightier stakes, granting not only more earnings per block but an increased number of blocks to validate.

Yet, be mindful, with greater stake comes graver peril. As with any investment, prudence dictates not to stake more than one can afford to lose.

Staking your currency allows you to retain ownership, with the option to unstake and sell when desired. Yet, take heed, many cryptocurrencies require a minimum time for staking, which means they cannot be unlocked until that time is up.

Which Crypto Coins Can Be Staked?

Staking is available for all cryptocurrencies that use the “proof-of-stake (PoS)” model. Many cryptocurrencies can be staked. However, it depends on the platform. Not all platforms might list every single “stake-able” cryptocurrency out there.

According to Forbes, there are about 80 cryptocurrencies available that can be staked.

Some popular ones include Ethereum, Chainlink, Polkadot, and Tezos. Each has its own staking process and potential rewards.

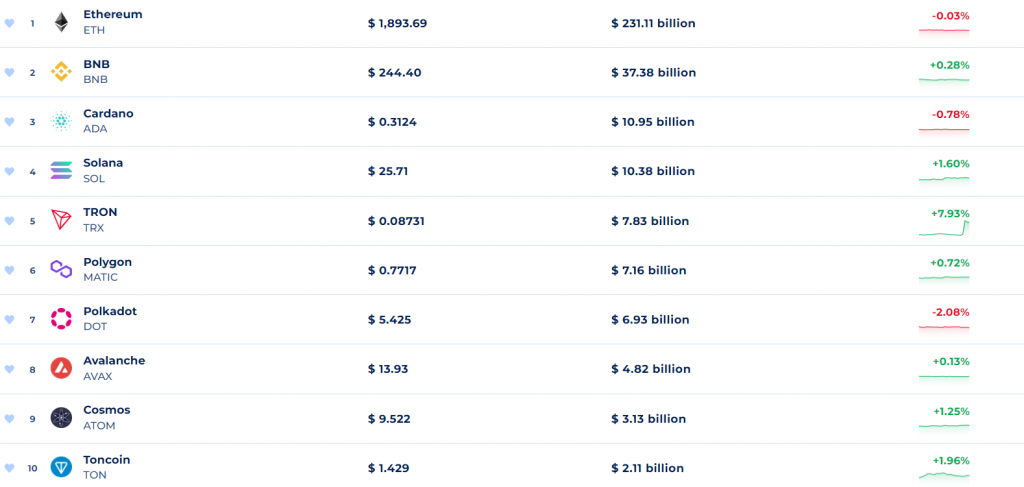

Top staking coins listed by market cap on Coinranking

Ethereum is a popular cryptocurrency that can be staked. It uses a PoS consensus mechanism called Ethereum 2.0. Stakers can earn rewards by locking up their Ethereum in a compatible wallet.

Chainlink is another cryptocurrency that can be staked. It’s used to power decentralized oracle networks. Stakers can earn rewards by holding their Chainlink in a compatible wallet and participating in the network.

Polkadot is a cryptocurrency that can be staked. It’s used to power a network of interconnected blockchains. Stakers can earn rewards by locking up their Polkadot in a compatible wallet and supporting the network.

Tezos is another cryptocurrency that can be staked. It’s used to power a self-amending blockchain platform. Stakers can earn rewards by holding theirTezos in a compatible wallet and participating in the network.

These are just a few examples of cryptocurrencies that can be staked. There are many others, each with its own staking process and potential rewards.

In the next section, we’ll look at where you can stake your cryptocurrency and the different platforms available for staking.

Where Can I Stake Crypto?

You can stake your cryptocurrency on different platforms. Some popular ones include exchanges, cold or private wallets, and staking-as-a-service platforms.

The following table lists staking methods along with their pros and cons and estimated popularity of usage:

| Staking Method | Example | Pros | Cons | Estimated Usage |

| Exchanges | Binance, Coinbase | Easy to use, integrated with trading platform | Centralized, potential for platform failure | 40% |

| Cold Wallets | Ledger, Trezor | High security, full control over funds | More complex setup, potential for user error | 30% |

| Private Wallets | MyEtherWallet, MetaMask | Full control over funds, easy to use | Lower security than cold wallets, potential for user error | 20% |

| Staking-as-a-Service Platforms | Figment, Staked | Easy to use, professional management | Centralized, potential for platform failure | 10% |

Please note: The estimated usage percentages are not based on any specific data or research and are included only for illustrative purposes.

Exchanges are a popular place to stake cryptocurrency. Many exchanges, such as Binance and Coinbase, offer staking services for their users. You can stake your cryptocurrency directly on the exchange and earn rewards.

Cold or private wallets are another option for staking. These are wallets that you control, such as hardware wallets or software wallets installed on your computer. You can stake your cryptocurrency by transferring it to the wallet and following the staking process for the specific cryptocurrency.

Staking-as-a-service platforms are another option for staking. These are platforms that specialize in staking and offer staking services for multiple cryptocurrencies. You can stake your cryptocurrency on these platforms and earn rewards.

Each platform has its own features, fees, and potential rewards. It’s important to choose a platform that meets your needs and offers the best returns for your staked cryptocurrency.

In the next section, we’ll look at how to choose a staking platform and what factors to consider.

How To Choose a Staking Platform

Choosing a staking platform is an important decision. You want to make sure that your precious crypto assets are safe and secure, and that you’re getting the best possible returns for your staked funds. Here are some factors to consider when choosing a staking platform:

- Security: The security of your cryptocurrency should be your top priority. Look for a platform that has a good reputation and takes security seriously. Make sure the platform uses two-factor authentication and other security measures to protect your funds. For instance, you might choose a platform like Binance or Coinbase, which have established reputations for security and use two-factor authentication to protect user accounts.

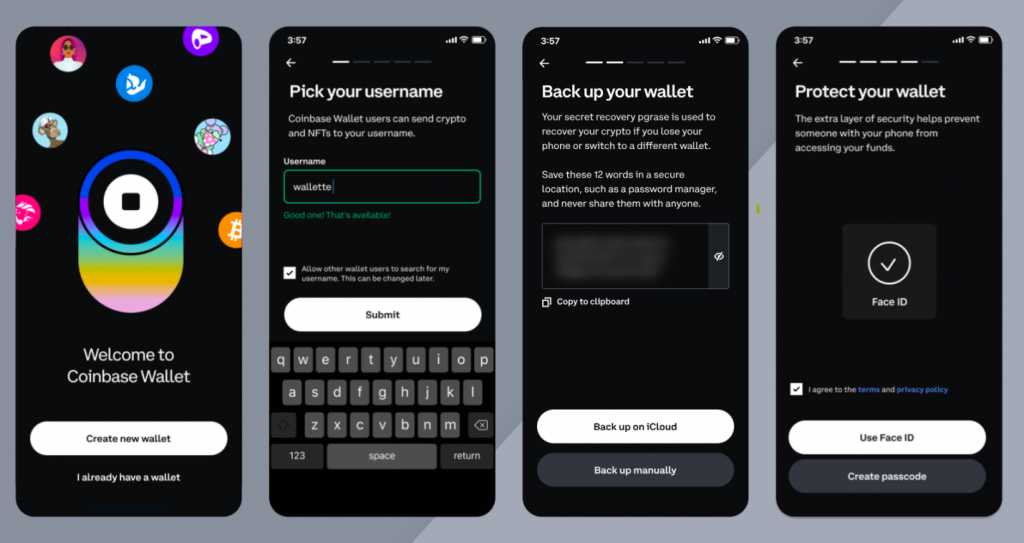

Source: www.coinbase.com

2. Fees: Staking can be a great way to earn passive income from your cryptocurrency, but fees can eat into your returns. Make sure you understand the fees charged by the platform, and compare them to other platforms to make sure you’re getting a good deal. For instance, some platforms like Kraken or Binance offer very low fees for staking, while others may charge higher fees.

3. Potential rewards: The potential rewards offered by the platform are another important factor to consider. Compare the rewards offered by different platforms to make sure you’re getting the best possible returns for your staked cryptocurrency. For instance, some platforms like Celsius or BlockFi offer high interest rates for staked cryptocurrency, while others may offer lower rates.

4. User experience: Staking can be complex, so it’s important to choose a platform that makes it easy for you. Look for a platform with a user-friendly interface and good customer support. You want a platform that makes it easy to stake your cryptocurrency and manage your rewards. For instance, you might choose a platform like Coinbase or Binance, which have user-friendly interfaces and offer good customer support.

By considering these factors, you can choose a staking platform that meets your needs and offers the best possible returns for your staked cryptocurrency. Remember, without the right platform, a potentially high yield can turn into a nightmare situation, so take the time to do your research and make an informed decision.

How To Stake Crypto

Staking crypto is easy. You can do it on an exchange or hardware wallet. The generic process for staking crypto is as follows:

- Choose a platform: Decide where you want to stake your cryptocurrency. You can use an exchange, a hardware wallet, or a staking-as-a-service platform.

- Transfer your cryptocurrency: Send the cryptocurrency you want to stake to the platform.

- Follow the staking process: Each platform has its own staking process. Follow the steps to start staking your cryptocurrency.

- Earn rewards: Once you start staking, you’ll earn rewards in the form of more cryptocurrency.

- Unstake your cryptocurrency: If you want to stop staking, you’ll need to unstake your cryptocurrency. Follow the platform’s unstaking process to access your funds.

However, each platform has their own unique process. Here is the staking process for some of the most well-known staking platforms:

How to stake coins on Coinbase

- Log in to your Coinbase account: Then locate the “Earn” tab on the right side of the homepage (and every page).

- Go to the Coinbase Earn page: You can see the assets you have to stake in the Get Started box.

- Choose the asset you want to stake: After clicking “Stake ETH” (or whichever asset you choose to stake), you will see a prompt with more information.

- Monitor Your Staked Coins: After staking your coins, you can monitor them by going back to the Earn center on Coinbase’s website or app. Here, you will see a list of all your staked coins along with their current status and estimated yield.

- Collect Your Yields: Your rewards will be automatically credited to your account. You can view your rewards by going back to the Earn center on Coinbase’s website or app.

- Unstake Your Coins: If you want to unstake your coins, you can request to do so at any time. However, you may have to wait until the unstaking process is completed by the network before you can transfer or sell your asset. The length of time this takes varies depending on the asset.

How to stake coins on Binance

- Navigate to the ‘Locked Staking’ Page: Once you enter your account, from the top panel go to Finance ->Binance Earn. Find the “Locked Staking” section and click on “Go to Staking”.

- Filter Available Staking Options and Find Your Coin: In the “Locked Staking” panel, check the “Display Available Only” option. This will show you only the coins that are currently available for staking. You can also use the search bar to find a specific coin.

- Review Staking Parameters and Stake: Once you have found the coin you want to stake, click on it to see the staking parameters. These include the minimum and maximum amount of coins you can stake, the staking period, and the estimated annual yield. Review these parameters carefully before proceeding. If you agree with the terms, enter the amount of coins you want to stake and click on “Stake Now”.

- Monitor Your Staked Coins: After staking your coins, you can monitor them by going back to the “Locked Staking” page. Here, you will see a list of all your staked coins along with their current status, staked amount, and estimated yield.

- Wait for the Staking Period to End: Once you have staked your coins, you will need to wait for the staking period to end before you can collect your yields or unstake your coins. The length of the staking period varies depending on the coin and the terms of the staking contract.

- Collect Your Yields: When the staking period ends, your yields will be automatically credited to your account. You can view your yields by going back to the “Locked Staking” page and clicking on “History”. Here, you will see a list of all your past staking transactions along with their yields.

- Unstake Your Coins: If you want to unstake your coins after the staking period has ended, go back to the “Locked Staking” page and find the coin you want to unstake. Click on it and then click on “Redeem”. Follow the instructions to complete the unstaking process.

How to stake coins on Kraken

- Navigate to the “Earn” tab: Choose the asset you’d like to stake.

- Click the “Stake” Symbol: On the right side of the module to stake your asset.

- Monitor Your Staked Coins: After staking your coins, you can monitor them by going back to the Earn tab on Kraken’s website or app.

- Collect Your Yields: Your rewards will be automatically credited to your account.

- Unstaking your coins: If you want to unstake your coins, you can do so at any time by clicking on the ‘Unstake’ button. However, certain assets have a bonding period, which means that rewards will not begin to accrue to your account until the asset has been staked for a period of time

How to stake coins on Ledger

- Install the crypto app on your Ledger device: Choose the third-party wallet you wish to use.

- Add funds to your device using the selected wallet: Start staking and earn rewards.

- Navigate to the “Earn” tab: Choose the asset you’d like to stake.

- Monitor Your Staked Coins: After staking your coins, you can monitor them by going back to the Earn tab on Ledger’s website or app.

- Collect Your Yields: Your rewards will be automatically credited to your account.

- Unstaking: If you want to unstake your coins, you can do so at any time by clicking on the ‘Unstake’ button.

How to stake coins on Metamask

- Visit portfolio.metamask.io: Toggle to the staking tab to choose your desired staking provider and click “Stake”.

- Enter the amount you want to stake: Click “Review”.

- Review your stake: Click “Confirm”.

- Sign the transaction in your wallet: When your transaction is complete, click “View holdings”.

- Monitor Your Staked Coins: After staking your coins, you can monitor them by going back to the staking tab on MetaMask’s website or app.

- Collect Your Yields: Your rewards will be automatically credited to your account.

Note: MetaMask Staking currently allows you to stake ETH through the Lido or Rocket Pool protocols

How to stake coins on Figment

- Create a Figment account: Visit the Figment website and create an account.

- Connect your wallet: Connect your Ethereum wallet to the Figment staking app.

- Select the Ethereum network: Choose the Ethereum network from the list of available networks.

- Stake your ETH: Follow the instructions provided by the Figment staking app to delegate your ETH to their validator node and start earning rewards.

- Monitor Your Staked Coins: After staking your coins, you can monitor them by going back to the Figment staking app. Here, you will see a list of all your staked coins along with their current status and estimated yield.

- Collect Your Yields: Your rewards will be automatically credited to your account.

Now that you know the ins and outs of crypto staking, let’s look at some potential benefits as well as some very significant risks that could arise with crypto staking.

Benefits and Risks of Staking Crypto

The obvious benefit is the increase in passive income you will get while staking crypto. People with a lot crypto assets can earn quite well if they stake through the right platforms and choose the right coins.

However, staking crypto also has risks. One such risk is market volatility. The value of your staked cryptocurrency can rise or fall rapidly, which can affect your returns. Another risk is platform failure. If the platform where you stake your cryptocurrency fails, you could lose your staked funds.

For instance, in the past, staking platforms have been hacked or have experienced technical issues, resulting in losses for users. In 2021, BitMart exchange lost almost $200 million in crypto to theft. It’s important to carefully consider the risks before staking your cryptocurrency.

Other risks associated with staking include lock-up periods, where your funds are inaccessible for a certain period of time, and impermanent loss, where the value of your staked cryptocurrency drops during the staking period.

Overall, while staking crypto can provide potential benefits in the form of passive income, it’s important to carefully consider the risks and make an informed decision before staking your cryptocurrency.

The Future of Crypto Staking

The future of crypto staking is bright. Increased adoption of PoS-based blockchain systems and continued growth and evolution of the DeFi space are likely.

PoS-based blockchain systems are becoming more popular due to their energy efficiency and potential for more predictable rewards. As more blockchain networks adopt PoS, the demand for staking is likely to increase.

The DeFi space is also growing and evolving. DeFi platforms offer new ways to earn passive income from cryptocurrency, including staking. As the DeFi space continues to grow, the opportunities for staking are likely to expand.

Overall, the future of crypto staking looks promising. With increased adoption and continued growth, staking is likely to become an even more popular way to earn passive income from cryptocurrency.